We take care of your

|

Best Financial Consulting Services in India – Finance Consultants

Accountant foundry provides best financial consulting services in India. We have a group of qualified and experienced Chartered Accountants in India, established with the objective of providing professional financial consulting services including Accounting, Auditing, and Tax compliance with high quality and sincerity to our clients. Hire the best financial advisors in India today!

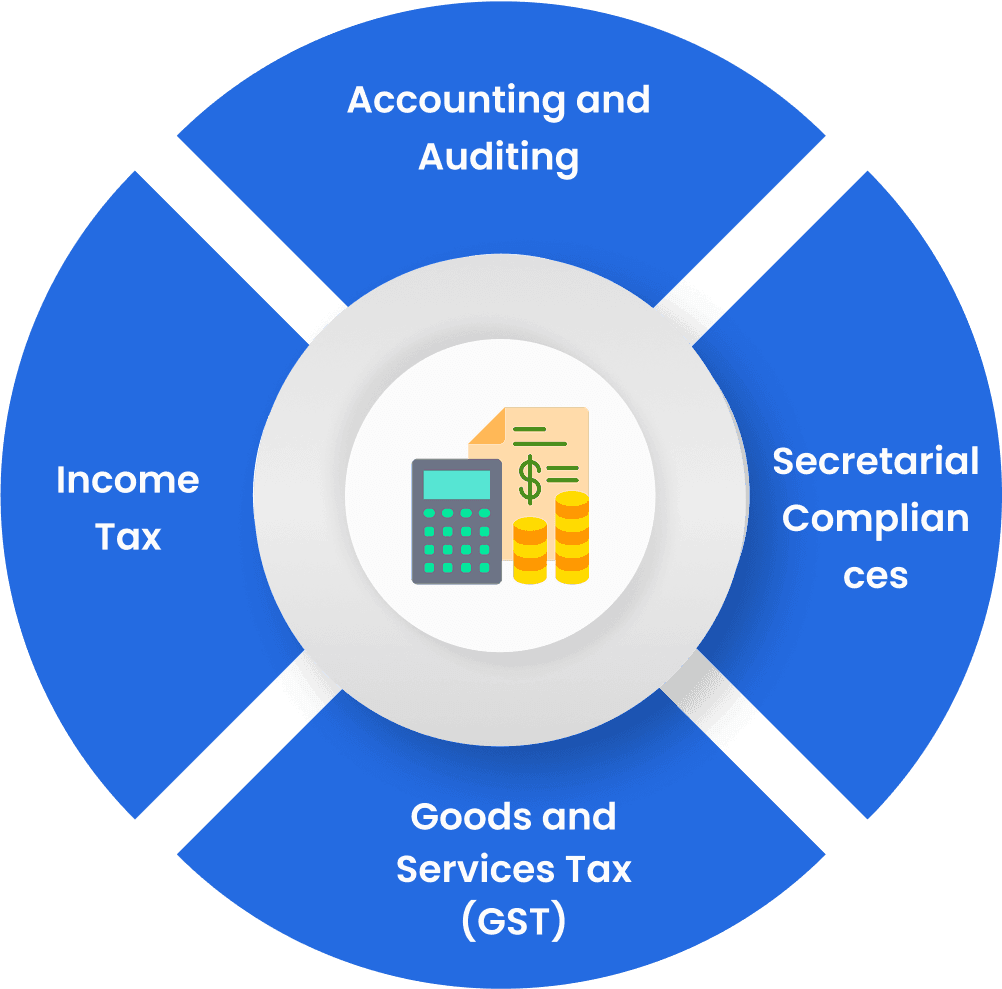

Our Financial Consulting Services in India

Being one of the top financial consultants in India, we offer complete financial consulting services, our core practice revolves around assisting organizations to be compliant with all legal and statutory compliances. We also help them design, develop, and implement key controls for critical operations for the smooth functioning of the business with great efficiency and diligence.

Being the leading financial advisory company in India we welcome new companies as well, to set up business in India assisting them in getting acquainted with the new legal environment and helping them manage their day-to-day operations. Our team consists of top CAs in India that approach each task in a systematic manner and ensure the timely completion of the allocated assignments. Our team of expert Chartered Accountants provide the following services:

Accounting and Auditing

Our team includes the best chartered accountants in India who have the requisite experience in the preparation and maintenance of books of accounts. We have dedicated resources who can provide you with Audit-related services.

It includes recording day-to-day transactions and performing month-end reconciliations. We also assist companies with Accounts Receivable and Payable management. Hire one of the best financial consulting company in India for your accounting/Bookkeeping!

Every company registered in India and having a prescribed turnover and must have an internal audit system to keep a check on the internal controls existing in their company. And being the best financial advisors in India, we provide internal audit-related services for our clients and help them design and implement controls that are secure and efficient as per the prescribed Standards on Auditing issued by ICAI from time to time.

IFC refers to Internal Financial Controls testing over the financial reporting framework. This is a mandatory requirement of the Companies Act, 2013 which requires companies to maintain adequate documentation around internal controls and expects statutory auditor to test these controls and opine about the same in their annual report. Hire one of the top financial consulting companies for your IFC testing now!

We provide audit support to our clients and help them easily complete their statutory audit within the set timelines. We prepare relevant documentation which is necessary to stay compliant with the requirements of the external auditor. Hire our team of India’s top CAs for your Audit support!

Our Compliance audit include detailed testing of internal controls to ensure smooth functioning of key operations of the business.

Through our online financial advisory services in India, we prepare MIS (Monthly Information System) to keep track of the performance of the company and share the same with the decision-makers for review and assessment.

It includes preparation of budgets for our clients. We help companies set their yearly targets and analyze the same with the actual targets achieved regularly throughout the year. Hire the best financial consultants in India for your budget preparation!

Cash Flow Support includes preparing monthly Cash Flow Statements for the management to showcase the flow of money earned in a month by the Company and the major expenses of the company where the earned amount is spent.

Being one of the best financial consulting company in India, our payroll management include processing payroll, monthly TDS liabilities, and calculating full and final settlements of employees on payroll software.

We at Accountant Foundry have top chartered accountants in India, who help us in preparing the monthly Cash Burn of the Company which helps them understand the spending frequency of cash balance.

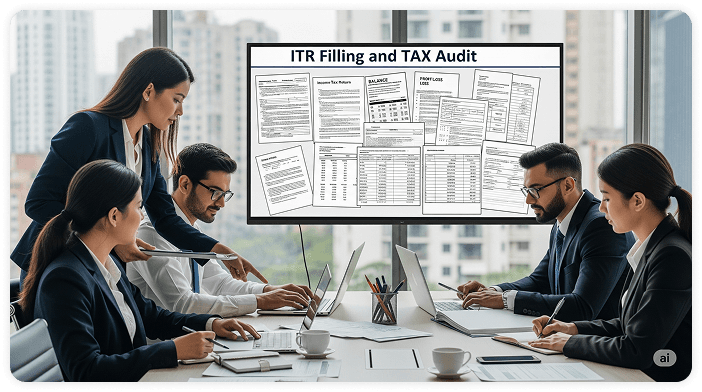

Income-Tax

We excel at providing Income-tax related services to all taxpayers including companies, LLPs, Proprietors, NGOs’ etc. Our financial consulting services includes different Tax filing, Tax documentation, and Tax planning.

Our CAs will help you file your annual Income-tax return and guide you on how to save tax for the next year.

We will file your quarterly TDS and TCS returns through a team of qualified and experienced Chartered Accountants who will also assist you in calculating your monthly TDS and TCS liabilities.

We will help you assess the applicability of a Tax Audit, filing Form 3CD, and Form 3CA-3CB, and preparing requisite documentation to stay compliant with the Income-tax Act.

It include filing Form 3CEB, preparing TP study, and helping companies maintain relevant documentation required as per the Income-tax Act.

We have a dedicated team of CAs that have expertise in Income Tax and lawyers who assist our clients in filing replies to Tax notices and represent them in front of Tax authorities.

We help clients get their registration under 12A (exemption from income-tax) and 80G (to give incentives to donors and in turn fund non-profit organizations) of the Income-tax Act, 1960 to assist Section 8 companies, Charitable trusts, and NGOs in get the requisite benefit to operate.

Being among India’s top financial advisors, we help non-profit organizations like Section 8 Companies, Charitable Trusts, and NGOs comply with the annual filing requirements and maintain crucial documentation expected from such organizations.

Foreign Currency Gross Provisional Return is filed for intimating RBI, that a company is allotting shares to a foreign investor against the amount of investment received from the foreign entity.

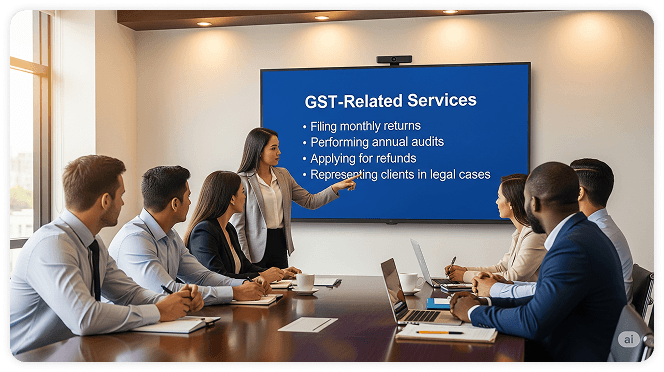

Goods and Services Tax (GST)

We also cater to GST-related services for our clients which include filing monthly returns, performing annual audits, applying for refunds, and representing our clients in their legal cases.

We apply for GST registrations for all business entities which help them start their financial operations appropriately.

We have a team of CAs that expertise in GST, who file your monthly/ quarterly GST returns and assist you in paying your monthly GST liabilities after taking the correct input.

We file GST Annual Return (for businesses with turnover above INR 2 crore) and perform GST Audit (for businesses with turnover above INR 5 crore) for our clients.

Our team of professionals helps companies apply for GST refunds on a timely basis and get their money back as soon as possible.

Through our expert CA team of GST professionals and lawyers, we help our clients reply to show cause notices and represent them in front of GST authorities.

We prepare monthly GST reconciliations for GST outward and GST Inward supplies shown in GSTR 3B, GSTR 1, and Books of accounts. We also reconcile the GST input appearing in GSTR 2A/2B with the input taken in the books of accounts.

Secretarial

We are the best financial consulting services in India in respect of secretarial compliance to be followed by companies registered in India. We have specialists who file your requisite documents with the Registrar of Companies and help you stay ahead of all the statutory deadlines.

We apply for GST registrations for all business entities which help them start their financial operations appropriately.

- Public Company

- Private Company

- One-person company

- Section 8 Company (Non-profit organization)

- Limited Liability Partnerships

Our company secretaries file your annual returns and prepare requisite documents like the Director’s Report, Board Minutes, Board resolutions, Director disclosure of Interest, and Declaration of disqualification, etc.

We also take care of other statutory filings like DPT3, Director KYC, Forms 8 and 11 for LLPs, MSME 1 forms, and CSR forms for our clients.

Other Miscellaneous Services

At Accountant Foundry, we take care of a few other important aspects of businesses through our qualified team of top Chartered Accountants in India. These services support our clients and direct their focus to other key business areas.

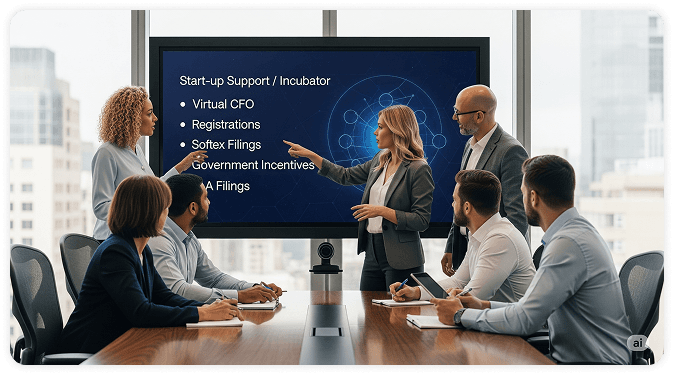

We provide full support to new start-ups including foreign investors/ companies willing to set up businesses in India.

We have one of the top chartered accountants in India who provides Virtual CFO which include services like managing Finance Departments of companies and performing all tasks that are envisaged to be performed by a CFO.

Some of the key areas covered under this are Business Valuation, Financial Reporting Valuation, Regulatory and Compliance Valuation, and Transaction Valuation, etc.

We have top CAs in India who are experts in the field of Due Diligence enabling us to perform different kinds of services like Financial Due Diligence, Tax Due Diligence, Revenue Due Diligence, Legal Due Diligence, Environmental Due Diligence, etc.

We have dedicated resources who help clients in being compliant with FEMA and RBI regulations.

We have top CAs in India who will help you in maintaining export-import documentation, issuance and renewal of IEC, and adhering to all other regulatory guidelines.

We cater to all aspects of the SOFTEX form submission to ensure accurate and timely documentation of software exports, coordination with STPI authorities, and compliance with RBI guidelines.

We assist our clients in applying and securing various government incentives like Make In India, Startup India, Export Incentives, etc. through our pool of professional Chartered Accountants.

Through our crew of expert CA professionals, we help our clients in preparing and submitting Foreign Liabilities and Assets (FLA) returns to the Reserve Bank of India.

We are proficient in getting you all the requisite registrations required to do business in India. Following is the list of registrations which we can apply for you:

- Provident fund (PF)

- Employee State Insurance (ESIC)

- Import Export Certificates (IEC)

- MSME or Udyog Adhaar

- FSSAI

- TAN

- Start-up registration

- Professional tax registration

- State Labor law registration.

- SEZ-STPI registration

- LUT Application

- Shop and Establishment Registration and Compliance

- Municipal Corporation registration

Why Choose our team of Chartered Accountants in India

Accountant Foundry is an organization that offers a comprehensive suite of financial services tailored to your specific business needs. By associating with us you will have:

In-depth Expertise

Our team of qualified and experienced CAs has all the requisite knowledge and skills to help deal with various regulatory issues and tax compliance issues.

Comprehensive Service

We have a full spectrum of financial services that are important to run a business in India.

Statutory Compliance

We ensure that a company never falls short of any regulatory compliance minimizing the risk of penalties and late fees.

Client-centric Association

Our goal is to prepare a package of services for our clients that are specific to their needs and infrastructure.

Growth-Oriented

We aim to help businesses grow by plucking out loopholes and smoothening processes.

Diversified Experience

We have 10+ years of experience working with start-up, MNCs’ and SMEs’ providing financial solutions.

Work Process of Top Financial Consulting Company in India

Preliminary Meeting

Setting up a meeting with the client’s decision-makers and understanding the nature of the service required by them.

Needs Assessment

Review the existing financial situation of the client and go through the existing accounting practices, compliance status, and tax filings.

Conducting a thorough assessment of the current situation and identifying areas where we can add value to the company and improve its efficiency.

Engagement Letter

Drafting an engagement letter with a detailed scope of work to be performed by us, timelines of each activity, and fees to be charged for the same.

Share the Draft engagement letter with the client mentioning all our relevant terms and conditions of the assignment.

Document & Info Sharing

Request the client to share all the relevant documents/ details about the task assigned to us.

Ensure confidentiality of all the details/ information received from the client.

Onboarding Meeting

Schedule an onboarding meeting to introduce the dedicated team to the client.

Discuss the timelines, mode of communication, and regular reporting deliverables.

Initial Review & Planning

Perform an initial review of progress done on the client’s financial data and identify corrective actions to remove discrepancies

Prepare a tailored financial plan and compliance checklist customized to the client’s business needs.

Service Execution

Execute the designed plan and perform the mutually agreed service.

Regularly communicate with the client to provide them updates and resolve any queries of the client.

Feedback & Improvement

Take regular feedback from the client improve delivery of service and address their concerns.

Improve the overall service experience by considering client’s feedback and concerns.

Conclusion

he above-mentioned steps help us to ensure a smooth and efficient delivery of services and set up a strong foundation for a new professional relationship with our clients.

Frequently Asked Questions

We offer a full spectrum of financial services in the field of accounting, income tax filing, GST filing, and other statutory compliances applicable to a company operating in India. We provide customized packages for Companies, LLPs’, Corporations, and Individual entrepreneurs.

You can reach us directly at the number and email provided on the website’ contact us webpage. We will organize a consultation call to understand your requirements and prepare a tailored solution. You can also visit our premises for a One-on-One discussion for a more detailed solution.

Our group of chartered accountants will guide you, each month in the case of TDS and quarterly in case of Advance Tax, on how much tax is to be deposited to evade any interest/ penalty liabilities that might accrue in case of non-payment or delayed payment.

Outsourcing financial services to our CA team will ensure efficiency, accuracy, and timely delivery of all deliverables along with subject matter experts being at your disposal for various tax complications that you might face. It allows you to operate your business more effectively with us handling your financial records and compliances.

Our Financial consulting services have a dedicated team of Tax experts with the knowledge and skills to perform comprehensive tax planning to save your excess tax liability. This involves identifying eligible deductions, exemptions, and investment options to ensure optimal tax savings.

Our financial advisory’s priority is to be confidential concerning each client and maintain the property security of the data received from different sources. We use secure servers, encrypted communications, and strict data protection policies. All our team members handle all client information with the utmost confidentiality and maintain proper secrecy.